FINANCIAL INSTITUTIONS (FISI)·Q4 2025 Earnings Summary

Financial Institutions Inc Beats Q4: Record NII, NIM Expansion Fuels Turnaround

January 30, 2026 · by Fintool AI Agent

Financial Institutions Inc (NASDAQ: FISI), the $6.3 billion-asset parent of Five Star Bank, delivered its fourth consecutive quarter of profitable growth with Q4 2025 EPS of $0.96, topping the $0.945 consensus by 1.6%. Total revenue of $64.1 million beat estimates by 1.8%, powered by record quarterly net interest income of $52.2 million and a net interest margin of 3.62%—up 71 basis points year-over-year. The stock closed up 3.0% on the news.

The quarter capped a dramatic turnaround year for the Western New York-based community bank. Full year 2025 net income available to common shareholders swung to $73.4 million ($3.61 per share) from a loss of $43.1 million ($2.75 loss per share) in 2024—a year marred by a $100 million securities restructuring loss and a $23 million litigation settlement.

Did Financial Institutions Inc Beat Earnings?

Yes, FISI beat on both revenue and EPS for Q4 2025:

The beat was driven by continued margin expansion from the December 2024 securities restructuring, which replaced low-yielding available-for-sale securities with higher-yielding assets. The investment securities portfolio yield expanded to 4.48% in Q4 2025, up 210 basis points from the year-ago quarter.

Beat/Miss History (Last 8 Quarters):

*Q4 2024 loss driven by $100M securities restructuring charge

How Did the Stock React?

FISI shares closed at $32.93 on January 29, 2026, up 3.0% on the day of the earnings release. The stock is trading near its 52-week high of $33.73 and has gained 56% from its 52-week low of $20.97.

Key Valuation Metrics:

What Did Management Say?

CEO Martin Birmingham highlighted the company's execution against 2025 targets:

"Our 2025 performance reflects our team's strong execution against the targets we laid out at the start of this year and success in delivering profitable organic growth, highlighted by full year return on average assets of 1.20% and an efficiency ratio of 58%."

CFO Jack Plants emphasized capital deployment and balance sheet strength:

"Given the strength of our financial performance this year and our capital position, we were pleased to repurchase 1.7%, or approximately $10.8 million, of common shares in the final weeks of December. Share repurchases are an important component of our capital deployment strategy."

On the subordinated debt offering completed in December:

"In the fourth quarter, our capital actions included the repurchase of 1.7% of outstanding common shares and the successful completion of an $80MM sub-debt offering. The notes received a BBB- rating from Kroll, with Stable outlook, reflecting our improved profitability and capital position."

What Did Management Guide?

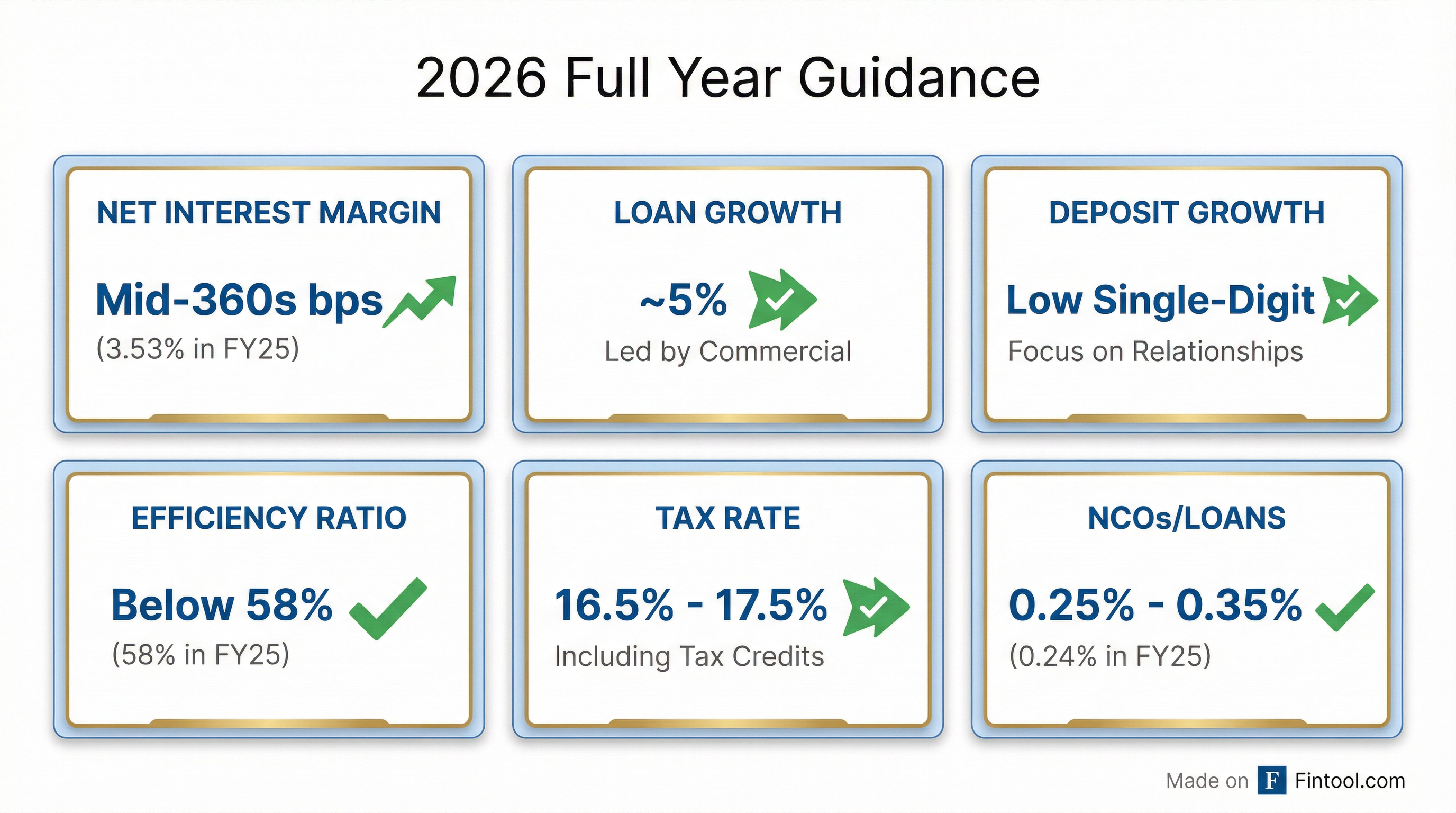

FISI provided detailed 2026 guidance focused on maintaining positive operating leverage:

Notable 2026 Outlook Items:

- COLI income expected at ~$10.5M on a full year basis

- Investment advisory income expected to grow at mid-single-digit rate

- Swap fees expected to moderate to $1M-$2M range

- Consumer indirect auto portfolio expected to continue running off, with run-off exceeding production

Q&A Highlights

On Margin Trajectory (Damon DelMonte, KBW):

December NIM was 3.56%, impacted by approximately 6 basis points from the mid-month subordinated debt offering. With the January redemption of the $65M in legacy sub-debt issuances complete, management expects margins to "start to expand incrementally on a monthly basis throughout the year."

On Interest Rate Sensitivity:

CFO Jack Plants noted the bank has "demonstrated the ability to reprice deposits pretty aggressively." If a 25 basis point rate cut occurs, margin guidance would largely hold given their deposit repricing capabilities. Approximately 40% of the loan portfolio is tied to variable rates with one-month or less repricing frequency.

On Loan Growth Cadence:

CEO Marty Birmingham expects commercial loan growth to be "lighter in Q1 and build through the year" due to strong Q4 closings and larger anticipated payoffs. Growth will be approximately equal-weighted between C&I and CRE on a percentage basis, though CRE will see more absolute balance sheet growth given its larger portfolio. The commercial pipeline has consistently been around $700 million for the last several years.

On Buyback Capacity (Manuel Navas, Piper Sandler):

The bank is projected to add 40-50 basis points of CET1 in 2026, providing capacity to continue buybacks. CFO Plants noted the 11% CET1 floor as his threshold, with year-end at 11.1%. With loan growth weighted to the back half, there's potential for more buyback activity in the first half of 2026.

On Deposit Strategy:

Management has invested in positioning the sales force, both commercial and retail, to understand the importance of deposits. Incentives have been reset for 2026 to reward strong deposit performance. Treasury management offerings on the commercial side were a success in 2025, and momentum is expected to continue in 2026.

What Changed From Last Quarter?

Positives:

- NII reached record levels: $52.2M quarterly, $200M annual—the highest in company history

- Commercial loans accelerated: Up $90.9M (+3.0%) in Q4, $215.7M (+7.5%) YoY to $3.08B

- Capital deployment activated: Repurchased 336,869 shares (1.7%) at $31.98 avg price in December

- Subordinated debt completed: $80M at 6.50% fixed, allowing refinance of older 2015/2020 issuances

- Tangible book value grew: Up 13.9% YoY to $27.84/share

Negatives:

- NIM compressed 3bps sequentially: 3.62% vs 3.65% in Q3, due to sub-debt offering impact

- Deposits declined seasonally: Down $151.5M (-2.8%) from Q3, driven by public deposit outflows

- NPLs ticked up: 0.77% of loans vs 0.74% in Q3, though down from 0.92% a year ago

- NCOs increased: 0.21% annualized vs 0.18% in Q3

Segment Performance

Loan Portfolio ($4.66B):

The consumer indirect auto portfolio continues its strategic wind-down, declining from $958M at year-end 2021 to $807M today. Management expects run-off to exceed production in 2026. The portfolio has an average loan size of approximately $20,000 and a weighted average FICO score exceeding 700, sourced through a network of more than 350 new auto dealers across New York State.

Geographic Diversification:

- Mid-Atlantic LPO contributed $398M (12% of commercial loans)

- Syracuse LPO "well-positioned for anticipated growth from tech-fueled investments in Central New York"

Wealth Management (Courier Capital):

- AUM: $3.60B at year-end

- Investment advisory income: $11.7M for FY25, up 9% YoY

- New office opened in Sarasota, FL to better serve clients

Credit Quality

Credit metrics remained solid despite slight sequential uptick:

Provision for credit losses was $3.4M in Q4, up from $2.7M in Q3, driven by loan growth and higher expected utilization for unfunded commitments.

CRE Concentration (47% of loans):

- Total CRE: $2.00B outstanding, $2.43B committed

- Office: $423M (4% criticized/classified)

- Multifamily: $822M (2% criticized/classified), no NYC/rent-regulated exposure

- ~23% of CRE exposure maturing within 12 months; "large majority" have recourse

Capital & Shareholder Returns

FISI's capital position strengthened considerably:

Shareholder Returns:

- Dividend: $0.31/share quarterly ($1.24 annualized), 3.95% yield; Board approved 3%+ increase for 2026

- Buyback: 336,869 shares repurchased in Q4 at $31.98 avg; New 2026 authorization for up to 5% of common shares

- Dividend payout ratio: 32% of Q4 net income

Key Risks to Monitor

-

CRE Concentration: 47% of loans in commercial real estate with 23% maturing in next 12 months; office represents $423M exposure

-

Consumer Indirect Run-off: Auto portfolio declining ~$40M/year, creates pressure on loan growth targets

-

Deposit Seasonality: Public deposits (21% of total) create quarterly volatility; Q4 saw $151M outflow

-

BaaS Wind-Down: Legacy banking-as-a-service deposits down to ~$7M from $100M a year ago; transition complete

-

Interest Rate Sensitivity: ~40% of loans are floating rate (Prime/SOFR indexed), creating margin risk in rate-cut scenarios

Forward Catalysts

- Micron Technology Syracuse Investment: Micron's long-anticipated $100 billion semiconductor investment officially broke ground in Syracuse in January. The build-out is expected to bring thousands of jobs and drive significant economic expansion. Management anticipates "more meaningful lending activity beginning this year as infrastructure, housing, and healthcare expand to support a larger anticipated population."

- Sub-Debt Refinancing Complete: January 2026 redemption of $65M in 2015/2020 issuances at lower rates

- Commercial Pipeline Execution: ~5% loan growth target weighted toward commercial, with ~$700M pipeline

- Continued Buybacks: 669,510 shares (~$21M at current prices) remaining under authorization; 40-50bps CET1 accretion projected for 2026

The Bottom Line

Financial Institutions Inc delivered a clean beat that validates its post-restructuring turnaround. Record NII, disciplined expense management (58% efficiency ratio), and active capital return signal a bank operating well above its historical average. The 2026 guidance for continued NIM expansion into the mid-360s and sub-58% efficiency ratio suggests further earnings power ahead. The stock's 8.6x forward P/E and 4% dividend yield offer value, though CRE concentration and auto portfolio run-off warrant monitoring.

More Resources: FISI Company Page | Q4 2025 Transcript | Q3 2025 Earnings